Ethical Investing Grow Your Money Responsibly

What is Ethical Investing?

Ethical investing, also known as sustainable, responsible, or impact investing, is an approach to investing that considers not only financial returns but also the social and environmental impact of the companies you invest in. It’s about aligning your investments with your values, supporting businesses that are committed to positive change, and avoiding those that contribute to harm. This could mean prioritizing companies with strong environmental, social, and governance (ESG) performance or excluding those involved in controversial industries like fossil fuels, weapons manufacturing, or tobacco.

Why Choose Ethical Investing?

For many, the reasons for choosing ethical investing extend beyond simply generating a return. It’s a way to make a tangible difference in the world. By investing in companies with strong ESG profiles, you’re essentially voting with your money, supporting businesses that are striving to create a more sustainable and equitable future. It also offers a sense of personal satisfaction knowing your investments are aligned with your values, contributing to a better world while building your financial future. Furthermore, some studies suggest that ethical investments can perform just as well, or even better, than traditional investments in the long run, mitigating some of the risks associated with companies with poor ESG performance.

Different Approaches to Ethical Investing

There are various approaches to ethical investing, offering different levels of engagement and scrutiny. Some investors choose to screen out companies involved in specific industries they find objectionable. Others might focus on positive screening, actively selecting companies that demonstrate strong ESG performance. Impact investing goes a step further, aiming to generate measurable social or environmental impact alongside financial returns. Finally, shareholder activism involves engaging directly with companies to encourage positive change in their practices. The best approach will depend on your personal values and investment goals.

ESG Factors: The Cornerstones of Ethical Investing

Environmental, Social, and Governance (ESG) factors are at the heart of ethical investing. Environmental factors consider a company’s impact on the planet, including its carbon footprint, waste management, and resource consumption. Social factors examine how a company treats its employees, customers, and the wider community, looking at issues like labor practices, human rights, and diversity. Governance factors assess a company’s leadership, transparency, and ethical conduct, including board composition, executive compensation, and corruption prevention.

Finding Ethical Investment Opportunities

Finding suitable ethical investments is easier than ever before. Many investment firms now offer ESG-focused funds and portfolios, providing diversified exposure to companies with strong ESG profiles. Online resources and rating agencies offer information on the ESG performance of individual companies, allowing you to research and make informed decisions. You can also consult with a financial advisor specializing in sustainable and responsible investing to help you navigate the options and create a personalized investment plan.

The Importance of Due Diligence

While ethical investing offers significant benefits, it’s crucial to conduct thorough due diligence before making any investment decisions. Not all companies claiming to be “ethical” actually live up to their claims, so it’s essential to critically examine the evidence and understand the nuances of ESG ratings and reporting. Look beyond marketing materials and delve into a company’s sustainability reports, independent audits, and news coverage to get a comprehensive picture of its performance.

Beyond the Investments: Making a Broader Impact

Ethical investing is more than just choosing the “right” companies; it’s about embracing a broader perspective on your financial life and how it intersects with your values. Consider your spending habits alongside your investments. Supporting businesses that align with your ethics in your day-to-day life amplifies the impact of your ethical investing strategy. This holistic approach ensures that your financial choices reflect your values consistently and effectively.

Long-Term Perspective and Patience

Ethical investing is a long-term strategy. Don’t expect overnight riches or immediate, drastic changes. The positive impacts of ethical investing often unfold over time, and financial returns may not always outperform traditional investments in the short term. However, by adopting a patient, long-term view, you contribute to building a more sustainable and equitable world while working towards your own financial goals. This requires patience and a commitment to consistent, responsible investing practices. Read also about ESG investing stocks.

ESG Private Equity Investing in a Better Future

What is ESG Private Equity?

ESG, standing for Environmental, Social, and Governance, is rapidly transforming the investment landscape. In the context of private equity, ESG investing means prioritizing companies that demonstrate strong performance across these three key areas. This isn’t just about doing good; it’s about identifying opportunities for superior risk-adjusted returns. Companies with robust ESG profiles often exhibit better operational efficiency, stronger employee engagement, and improved risk management, all of which can translate into higher profitability and long-term value creation. Integrating ESG factors into the due diligence process helps private equity firms make more informed investment decisions and mitigate potential risks associated with environmental damage, social unrest, or poor governance.

Environmental Considerations: A Focus on Sustainability

The environmental pillar of ESG focuses on a company’s impact on the planet. This encompasses various aspects, including carbon emissions, waste management, resource consumption, and biodiversity. Private equity firms are increasingly scrutinizing a target company’s environmental footprint, seeking opportunities to invest in businesses that are developing sustainable solutions or actively reducing their environmental impact. This might involve investing in renewable energy companies, supporting businesses committed to circular economy principles, or encouraging portfolio companies to adopt more energy-efficient practices. The growing awareness of climate change is driving a significant shift towards environmentally responsible investments, pushing private equity to embrace green technologies and sustainable business models.

Social Impact: Prioritizing People and Communities

The social aspect of ESG considers a company’s relationships with its employees, customers, suppliers, and the wider community. This includes factors like fair labor practices, diversity and inclusion initiatives, community engagement, and product safety. Private equity firms are increasingly looking beyond financial metrics, assessing a company’s commitment to its workforce and its positive contribution to society. Investing in companies with strong social practices can lead to improved employee morale, enhanced brand reputation, and reduced reputational risks. Moreover, supporting businesses that prioritize social responsibility aligns with the growing consumer demand for ethical and sustainable products and services.

Governance Matters: Ensuring Transparency and Accountability

Good governance is crucial for sustainable long-term value creation. This aspect of ESG focuses on a company’s leadership structure, board composition, risk management practices, and ethical standards. Private equity firms are increasingly demanding greater transparency and accountability from their portfolio companies. This includes scrutinizing corporate governance structures, assessing the independence and effectiveness of boards of directors, and evaluating the robustness of risk management frameworks. Strong governance practices help to minimize the risk of scandals, regulatory penalties, and reputational damage, ultimately contributing to more stable and profitable businesses.

The Financial Benefits of ESG Integration

While the ethical considerations are paramount, ESG integration also offers compelling financial advantages. Studies have shown a positive correlation between strong ESG performance and financial returns. Companies with robust ESG profiles often exhibit lower costs of capital, improved operational efficiency, and reduced risk exposure. Furthermore, investors are increasingly factoring ESG criteria into their investment decisions, leading to higher valuations for companies with strong ESG performance. Private equity firms that embrace ESG principles can attract a wider pool of investors, including those with specific ESG mandates, and command higher valuations for their portfolio companies.

Challenges and Opportunities in ESG Private Equity

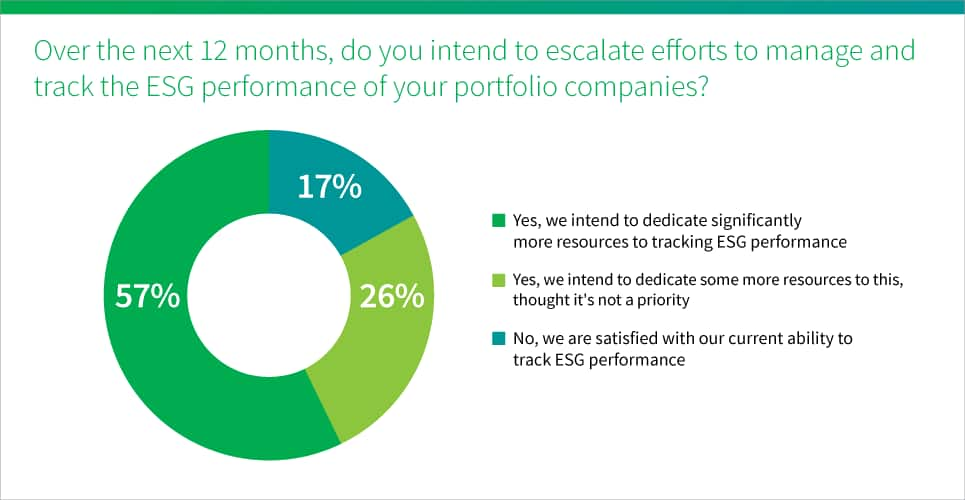

Despite the growing interest in ESG private equity, several challenges remain. One key challenge is the lack of standardized ESG metrics and reporting frameworks, making it difficult to compare the ESG performance of different companies. Another challenge is the need for more robust data collection and verification processes to ensure the accuracy and reliability of ESG information. However, these challenges also present significant opportunities. The development of more standardized metrics and improved data transparency will facilitate greater comparability and allow for more effective investment decisions. The growing demand for ESG data also presents opportunities for technology companies and data providers to develop innovative solutions to meet this need. Furthermore, the increasing focus on ESG creates significant opportunities for private equity firms to identify and invest in companies that are leading the charge towards a more sustainable and equitable future.

Beyond Compliance: Driving Positive Change

ESG investing is not simply about ticking boxes and meeting regulatory requirements; it’s about actively driving positive change. Private equity firms have the resources and influence to encourage portfolio companies to adopt more sustainable practices, improve their social impact, and strengthen their governance frameworks. This active engagement goes beyond compliance and seeks to create a meaningful and lasting impact. Through strategic partnerships, proactive engagement, and targeted investments, private equity firms can play a pivotal role in building a more sustainable and equitable future. By integrating ESG considerations into every stage of the investment process, from sourcing to exit, private equity firms can generate superior financial returns while making a tangible contribution to a better world. Please click here for information about ESG investing in private equity.

Fintech’s Next Big Thing What’s Changing Money?

The Rise of Embedded Finance

Forget standalone financial apps. Embedded finance is seamlessly integrating financial services into non-financial platforms. Imagine booking a flight and paying with a buy-now-pay-later option directly through the airline’s website, or ordering groceries and getting instant loan offers based on your spending habits. This isn’t science fiction; it’s the rapidly expanding world of embedded finance, where the lines between financial and non-financial businesses are blurring. This allows for increased convenience for the consumer and new revenue streams for businesses of all sizes.

The Power of Open Banking and APIs

Open banking, with its standardized APIs, is the engine driving this revolution. It allows third-party providers to access customer financial data with their consent, paving the way for personalized financial products and services. This data-driven approach unlocks opportunities for hyper-personalized recommendations, improved credit scoring models, and tailored financial advice, all while enhancing customer experience and security through regulated access.

Decentralized Finance (DeFi) and its Growing Influence

While still nascent, decentralized finance (DeFi) continues to disrupt traditional financial systems. By leveraging blockchain technology, DeFi offers transparent, permissionless financial services, bypassing traditional intermediaries. Although challenges regarding regulation and accessibility remain, DeFi’s potential to democratize finance and offer innovative solutions, like decentralized lending and borrowing platforms, is undeniable. The space is evolving rapidly, with increased security measures and improved user experience becoming priorities.

Artificial Intelligence (AI) and the Future of Personalized Finance

AI is transforming the financial landscape, powering everything from fraud detection to algorithmic trading. But its most impactful role might be in personalizing financial services. AI-powered robo-advisors are already offering customized investment strategies, while sophisticated algorithms are analyzing spending habits to offer tailored financial advice and even predict potential financial difficulties. Ethical considerations are paramount, however, to ensure fairness and prevent bias in AI-driven financial decision-making.

The Expanding Role of Blockchain Beyond Cryptocurrency

While cryptocurrency remains a significant part of the blockchain narrative, its application extends far beyond digital currencies. Blockchain’s inherent security and transparency make it ideal for tracking assets, streamlining supply chains, and securing digital identities. In finance, this translates to enhanced security for transactions, improved auditability, and potentially faster, cheaper cross-border payments. This technology is laying the foundation for a more secure and efficient financial system.

The Metaverse and the Future of Digital Payments

The metaverse, a persistent, shared 3D virtual world, presents unique challenges and opportunities for fintech. As more people interact and transact within these digital environments, new payment methods and financial systems will emerge. This could involve virtual currencies, decentralized marketplaces, and innovative forms of digital asset ownership, potentially reshaping how we think about money and financial transactions altogether.

Regulation and the Balancing Act

The rapid pace of fintech innovation necessitates a careful balancing act between fostering innovation and ensuring consumer protection. Regulators worldwide are grappling with how to adapt to this rapidly changing landscape, aiming to create a framework that encourages growth while mitigating risks associated with new technologies and business models. Finding the right balance will be crucial for the sustainable growth of the industry and maintaining consumer trust.

Sustainability and the Green Finance Movement

The growing awareness of climate change is driving a surge in green finance, with fintech playing a crucial role. From developing innovative financing mechanisms for renewable energy projects to creating platforms for sustainable investments, fintech is helping to channel capital towards environmentally friendly initiatives. This trend is likely to gain significant momentum in the coming years, shaping the future of finance and investment. Visit here to learn about fintech disruption.