ESG Investing Top Companies Leading the Charge

Microsoft: A Tech Giant Leading on Sustainability

Microsoft’s commitment to ESG is deeply woven into its business strategy. They’ve set ambitious goals for carbon neutrality, aiming to become carbon negative by 2030. This isn’t just a PR exercise; they’re investing heavily in renewable energy, carbon removal technologies, and sustainable supply chains. Their efforts extend beyond their own operations; they’re also working with their customers and partners to help them reduce their environmental impact, showcasing a holistic approach to corporate sustainability.

Unilever: Putting Sustainability at the Heart of its Products

Unilever, a consumer goods giant, exemplifies how ESG can be integrated into product development and marketing. They’ve committed to sustainable sourcing of raw materials, reducing their environmental footprint across their entire supply chain, and promoting sustainable consumption among consumers. Their brands are increasingly highlighting their sustainable attributes, resonating with environmentally conscious consumers. This strategy isn’t just ethically driven; it’s also commercially savvy, tapping into growing consumer demand for sustainable and responsible products.

Salesforce: A Pioneer in ESG Transparency and Reporting

Salesforce stands out for its transparency and robust ESG reporting. They’ve been pioneers in publicly disclosing their environmental and social performance, setting high standards for the industry. Their detailed reporting allows investors and stakeholders to assess their progress towards their sustainability goals, fostering accountability and trust. This emphasis on transparency contributes to building confidence and attracting investors who prioritize ESG factors.

Tesla: Revolutionizing Transportation with Sustainability at its Core

Tesla’s impact on the automotive industry is undeniable. By championing electric vehicles, they’re actively combating climate change and promoting sustainable transportation. Although some aspects of their ESG performance have been questioned, their core mission of producing clean energy vehicles remains a powerful driver of positive environmental impact. Their advancements in battery technology and renewable energy infrastructure further underscore their commitment to a sustainable future.

Apple: Supply Chain Transparency and Ethical Sourcing

Apple’s focus on ethical sourcing and supply chain transparency sets a high bar for other tech companies. They’ve made significant efforts to improve working conditions in their manufacturing facilities and ensure responsible sourcing of materials. Their commitment to using recycled materials and reducing their environmental impact throughout the product lifecycle demonstrates a sophisticated understanding of the challenges and opportunities presented by ESG considerations.

Danone: A Food Company Committed to Regenerative Agriculture

Danone, a global food and beverage company, is leading the charge in promoting regenerative agriculture. They’re working closely with farmers to adopt sustainable farming practices that improve soil health, biodiversity, and carbon sequestration. This commitment extends beyond their own supply chain; they’re actively supporting and investing in regenerative agriculture initiatives worldwide, contributing significantly to environmental stewardship.

BlackRock: A Financial Giant Integrating ESG into Investment Decisions

BlackRock, one of the world’s largest asset managers, has significantly increased its focus on ESG integration into its investment process. Their influence on corporate governance and sustainability practices is immense, as they wield considerable power as a major shareholder in countless companies. By actively engaging with portfolio companies on ESG issues, they are driving corporate change and promoting wider adoption of responsible business practices. Their decisions significantly impact the direction of ESG investing and the broader corporate landscape.

Nestlé: Addressing Water Stewardship and Sustainable Packaging

Nestlé’s commitment to water stewardship reflects the importance of resource management in ESG. Given the water-intensive nature of their products, their responsible water management practices are crucial. Furthermore, their efforts to reduce plastic waste and transition to sustainable packaging highlight the broader issue of sustainable consumption. These initiatives demonstrate a concerted effort to address some of the most pressing environmental challenges facing the food industry.

The Growing Importance of ESG Leadership

These companies aren’t just acting on ESG principles; they’re actively shaping the future of business. Their leadership demonstrates that a commitment to ESG is not only ethically responsible but also commercially viable. Their success is inspiring other companies to follow suit, accelerating the adoption of sustainable practices across various sectors and driving a positive change in the global economy. Learn more about ESG investing companies here.

Green Investing Your Guide to a Sustainable Future

Understanding Green Investing

Green investing, also known as sustainable or responsible investing, involves putting your money into companies and projects that prioritize environmental sustainability and social responsibility. This isn’t just about feeling good; it’s about recognizing that environmental and social factors directly impact a company’s long-term success and profitability. A company that damages the environment or mistreats its workforce faces higher risks and potentially lower returns in the long run. Green investing aims to identify and support businesses actively mitigating these risks.

Different Approaches to Green Investing

There are several ways to incorporate green principles into your investment strategy. You could choose to invest directly in companies that are leaders in renewable energy, sustainable agriculture, or green technology. Alternatively, you could invest in funds or ETFs (exchange-traded funds) that specifically focus on environmentally and socially responsible companies. These funds often use screening criteria to exclude companies involved in activities like fossil fuels, deforestation, or weapons manufacturing, while prioritizing those with strong environmental, social, and governance (ESG) ratings. Finally, you can engage in impact investing, where the primary goal is to generate positive social and environmental impact alongside financial returns.

Identifying Green Companies and Funds

Finding genuinely green investments requires careful research. Look for companies with publicly available sustainability reports, detailing their environmental performance, social initiatives, and governance practices. Independent rating agencies like MSCI and Sustainalytics provide ESG ratings that can help you assess a company’s commitment to sustainability. Similarly, when choosing funds, examine their investment strategies and portfolio holdings. Look for funds that clearly articulate their ESG criteria and regularly report on their impact. Don’t rely solely on marketing materials; delve deeper into the underlying data and methodologies.

The Role of ESG Factors

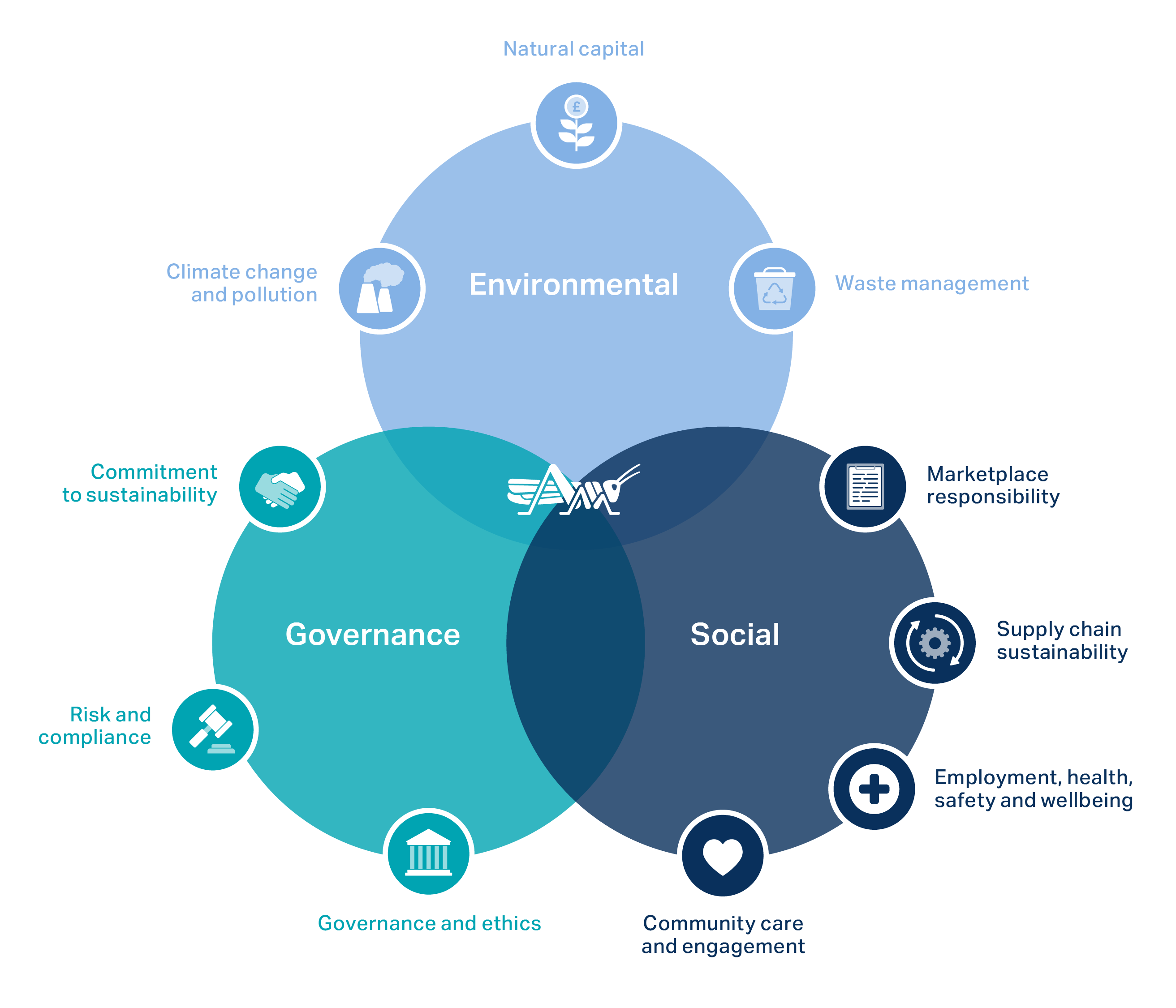

Environmental, Social, and Governance (ESG) factors are at the heart of green investing. Environmental factors consider a company’s impact on the environment, including its carbon footprint, waste management, and resource consumption. Social factors encompass its treatment of employees, suppliers, and the communities where it operates. Governance refers to its corporate structure, ethical practices, and transparency. Analyzing these factors helps investors assess a company’s long-term sustainability and potential risks, allowing for more informed investment decisions. Strong ESG performance is often correlated with better financial performance.

Beyond the Bottom Line: Social Impact

Green investing isn’t solely about financial returns; it’s also about contributing to a more sustainable and equitable future. By supporting companies that prioritize environmental protection and social justice, you’re aligning your investments with your values. Many green investments directly contribute to positive social change, such as clean energy initiatives that reduce carbon emissions or sustainable agriculture practices that protect biodiversity. This positive impact can be both personally fulfilling and contribute to a broader shift towards a more sustainable global economy.

Risks and Considerations in Green Investing

While green investing offers significant potential, it’s essential to acknowledge the risks. The green sector is still developing, and some green companies might not be as financially stable as established companies in other sectors. Furthermore, the definition of “green” can be subjective, and “greenwashing” – the practice of falsely portraying a company as environmentally friendly – is a concern. Thorough due diligence and a well-diversified portfolio are crucial to mitigate these risks. It’s also important to remember that returns in green investments might not always be immediate or higher than traditional investments. The focus should be on the long-term, sustainable growth potential.

Getting Started with Green Investing

Begin by assessing your personal investment goals and risk tolerance. Consider your values and how they align with different investment approaches. If you’re unsure where to start, consult a financial advisor who specializes in sustainable investing. Many brokerage firms now offer a range of green investment options, including ESG funds and impact investing opportunities. Start small, gradually incorporating green investments into your portfolio, and continuously monitor your investments to ensure they align with your evolving goals and values. Remember, sustainable investing is a journey, not a destination.

The Future of Green Investing

Green investing is no longer a niche strategy; it’s becoming increasingly mainstream. As awareness of climate change and social issues grows, more investors are demanding transparency and accountability from companies. Government regulations and international agreements are also driving the shift towards a more sustainable economy. This trend is likely to continue, making green investing not just an ethical choice but also a smart long-term financial decision. The future of finance is undeniably intertwined with the future of the planet, making green investing a crucial component of responsible investing for years to come. Click here to learn about a sustainable investing strategy.

Sustainable Investing Beyond the Buzzwords

Understanding the Scope of Sustainable Investing

Sustainable investing, or responsible investing, is far broader than simply avoiding “sin stocks” like tobacco or fossil fuels. It encompasses a wide range of strategies designed to generate positive social and environmental impact alongside financial returns. This means looking beyond short-term profits and considering the long-term implications of investments on various stakeholders, including employees, communities, and the environment. A truly holistic approach acknowledges that environmental, social, and governance (ESG) factors are intrinsically linked to a company’s financial performance and long-term sustainability.

ESG Factors: Beyond the Acronym

ESG is frequently used in sustainable investing, but its components deserve deeper examination. “Environmental” factors assess a company’s impact on climate change, resource depletion, pollution, and biodiversity. “Social” considerations evaluate a company’s treatment of its workforce, its commitment to human rights, and its engagement with local communities. “Governance” scrutinizes a company’s leadership structure, ethical practices, risk management, and transparency. Analyzing these factors helps investors understand the risks and opportunities associated with a given investment, leading to more informed decision-making.

Impact Investing: Driving Positive Change

Impact investing takes sustainable investing a step further by directly aiming to generate positive, measurable social and environmental impact alongside a financial return. This might involve investing in companies developing renewable energy technologies, providing affordable housing, or improving access to healthcare in underserved communities. It requires a rigorous evaluation of the impact of the investments and often involves working closely with the investee companies to track progress towards specific goals. The focus is not just on avoiding harm, but actively contributing to solutions.

The Materiality of ESG Factors

The increasing recognition of the materiality of ESG factors is a key driver of the growth of sustainable investing. Materiality refers to how significantly ESG issues can impact a company’s financial performance. For instance, a company facing reputational damage due to environmental controversies might experience decreased sales and a decline in its stock price. Similarly, a company with a strong commitment to employee wellbeing might experience higher retention rates and increased productivity. Understanding material ESG factors is crucial for identifying investment opportunities and avoiding potential risks.

Beyond the Greenwashing: Due Diligence is Key

The growing popularity of sustainable investing has, unfortunately, led to instances of “greenwashing,” where companies exaggerate their sustainability credentials to attract investors. To avoid falling prey to this, rigorous due diligence is paramount. Investors should look for evidence-based reporting, independent verification of ESG performance, and transparent disclosure of relevant data. Independent ratings agencies and specialized research firms can provide valuable insights into a company’s true sustainability practices. Critical evaluation and skepticism are essential to separate genuine sustainable companies from those merely paying lip service.

Integrating Sustainability Across Investment Strategies

Sustainable investing is not confined to specific asset classes or investment strategies. It can be incorporated into various approaches, including active and passive management, equity and fixed income investing, and even real estate. For instance, an active manager might engage directly with companies to promote better ESG practices, while a passive manager might choose an index that screens out companies with poor ESG performance. The key is to tailor the approach to your specific investment goals and risk tolerance while maintaining a commitment to sustainability principles.

Measuring and Reporting Impact: Transparency is Crucial

Measuring and reporting the impact of sustainable investments is crucial for demonstrating the effectiveness of the strategy and building accountability. This involves setting clear, measurable targets for both financial returns and social and environmental impact. Various frameworks and standards, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), provide guidance for reporting on ESG performance. Transparency in reporting is essential for fostering trust and attracting investors who prioritize sustainability.

The Future of Sustainable Investing: A Growing Movement

Sustainable investing is no longer a niche activity; it is becoming increasingly mainstream, driven by both investor demand and regulatory changes. As awareness of environmental and social issues grows, more investors are seeking investment options that align with their values and contribute to a more sustainable future. The continued development of robust measurement and reporting frameworks, along with stricter regulations against greenwashing, will further enhance the credibility and impact of sustainable investing. Learn about sustainable investing trends here.

Sustainable Investing Making Money & a Difference

What is Sustainable Investing?

Sustainable investing, also known as responsible investing or ESG (environmental, social, and governance) investing, goes beyond simply seeking financial returns. It integrates environmental, social, and governance factors into investment decisions. This means considering a company’s impact on the planet, its treatment of its workers and community, and its corporate governance practices alongside traditional financial metrics. It’s about aligning your investments with your values and contributing to a more sustainable future.

The Financial Case for Sustainable Investing

Many believe sustainable investing sacrifices profitability for ethical considerations. However, a growing body of research suggests that integrating ESG factors can actually enhance long-term financial performance. Companies with strong ESG profiles often demonstrate better risk management, innovation, and long-term resilience. They tend to attract and retain top talent, build stronger customer relationships, and face fewer regulatory and reputational risks. This translates into potentially higher returns and reduced volatility over time.

Identifying Sustainable Investments

Finding suitable sustainable investments can be easier than you think. Many asset managers now offer dedicated sustainable investment funds, ranging from equity and fixed-income portfolios to alternative investments. Look for funds that clearly outline their ESG criteria and investment strategies. Independent ratings agencies also provide ESG scores for companies, helping you assess their sustainability performance. It’s wise to engage with your financial advisor to identify investments aligned with your personal risk tolerance and ethical priorities.

Different Approaches to Sustainable Investing

There’s a spectrum of approaches within sustainable investing. Some investors focus on negative screening, avoiding companies involved in specific harmful activities like fossil fuels or tobacco. Others adopt positive screening, actively seeking out companies with strong ESG profiles. Impact investing aims to generate measurable social and environmental impact alongside financial returns. Finally, shareholder engagement involves actively engaging with companies to encourage them to adopt more sustainable practices.

Minimizing Greenwashing

It’s crucial to be wary of “greenwashing,” where companies exaggerate their sustainability credentials to attract investors. Do your due diligence. Scrutinize a company’s sustainability reports, looking for specific, measurable, achievable, relevant, and time-bound (SMART) goals. Independent verification of ESG data is a strong indicator of authenticity. Look for companies that transparently disclose their environmental and social footprint, as well as their governance structure.

Beyond Financial Returns: The Social Impact

The benefits of sustainable investing extend beyond personal finance. By investing in companies committed to sustainability, you’re directly contributing to positive change. Your investment dollars can support the transition to a cleaner energy future, promote social equity, and improve corporate governance practices. This has a ripple effect, fostering innovation, creating jobs in emerging green sectors, and improving the overall well-being of communities and the planet.

Getting Started with Sustainable Investing

Starting your sustainable investing journey is simpler than you might imagine. You can begin by gradually shifting a portion of your portfolio towards sustainable investments. Many brokerage accounts offer tools and resources to screen for ESG-focused companies and funds. Talk to your financial advisor to incorporate sustainable investing into your overall financial plan, ensuring it aligns with your risk tolerance and financial goals. Remember, even small changes can make a big difference.

The Future of Sustainable Investing

The sustainable investing landscape is constantly evolving. Increasing regulatory pressure, growing consumer demand for ethical products and services, and a rising awareness of climate change are driving more capital towards sustainable investments. As the field matures, we can expect greater standardization of ESG data, more sophisticated investment strategies, and even more compelling evidence of the link between sustainability and financial performance. The future looks bright for those seeking both financial returns and positive social and environmental impact. Read also about ESG sustainable investing.

Green Giants Top Sustainable Investing Firms

Parnassus Investments: A Pioneer in Socially Responsible Investing

Parnassus Investments has been a leader in sustainable and responsible investing (SRI) for decades. Their commitment goes beyond simply avoiding “sin stocks”; they actively seek out companies with strong environmental, social, and governance (ESG) profiles. Their investment process involves rigorous research, engaging directly with company management on ESG issues, and promoting positive change within the companies they invest in. They’re known for their long-term investment horizon and their focus on fundamental analysis, seeking companies with solid financial performance alongside strong ethical practices. This approach has resulted in consistent, strong performance over the years, proving that responsible investing doesn’t have to mean sacrificing returns.

Ackermans & van Haaren: European Sustainability Champion

Based in Belgium, Ackermans & van Haaren is a prominent example of a European firm deeply committed to sustainable investing. Their investment strategy is heavily influenced by ESG factors, and they actively engage with portfolio companies to encourage sustainable business practices. They’re particularly focused on long-term value creation, aligning their investment decisions with broader societal and environmental goals. Their portfolio spans diverse sectors, but a common thread is a commitment to innovation and sustainability within those industries. They represent a strong European voice in the global sustainable investing landscape.

Impax Asset Management: Focusing on the Environmental Impact

Impax Asset Management stands out for its laser focus on environmental markets. They invest in companies that are actively addressing environmental challenges, such as renewable energy, clean technology, and sustainable agriculture. Their deep expertise in environmental markets allows them to identify opportunities that other firms may overlook. This specialized approach allows them to contribute to solving pressing environmental issues while generating attractive returns for investors. Their success demonstrates the growing investment potential in companies tackling climate change and resource scarcity.

Triodos Investment Management: A Leader in Impact Investing

Triodos Investment Management is a pioneer in impact investing, a strategy that aims to generate both financial returns and positive social and environmental impact. They take a holistic approach, considering the entire value chain of their investments. They invest only in companies aligned with their values, which include promoting social justice, environmental sustainability, and ethical business practices. Their transparency and commitment to rigorous impact measurement allow investors to track the positive change their money is creating, setting a high standard for the industry.

Mirova: A Global Leader in Sustainable and Responsible Investment

Mirova, a subsidiary of Natixis Investment Managers, is a globally recognized leader in sustainable and responsible investment. They offer a wide range of investment strategies, from integrating ESG factors into traditional investment approaches to dedicated impact investing strategies. Their commitment to transparency and robust ESG integration sets them apart. Mirova actively engages with portfolio companies on ESG issues and promotes responsible business practices throughout their investment process. Their global reach allows them to identify and invest in leading sustainable businesses worldwide.

Brown Advisory: A Blend of Tradition and Sustainability

Brown Advisory represents a slightly different approach, showcasing how established firms are increasingly integrating sustainability into their core investment philosophy. They combine traditional investment expertise with a deep commitment to ESG factors, carefully considering the long-term implications of their investment choices. Their approach isn’t solely focused on “green” sectors but rather on identifying companies across various industries that demonstrate robust ESG performance and align with their overall investment strategy. This approach represents a growing trend within the investment industry where ESG is becoming a mainstream consideration, not a niche strategy.

Wellington Management: Integrating ESG into Core Investment Strategies

Similar to Brown Advisory, Wellington Management highlights the integration of ESG considerations into established investment strategies. They emphasize a thorough assessment of ESG factors alongside traditional financial metrics, demonstrating a commitment to responsible investing without sacrificing financial performance. Their large scale and resources allow them to conduct extensive ESG research and engage with companies on material ESG issues. Their approach represents a significant shift within the asset management industry, where ESG is no longer a secondary consideration but an integral part of their investment decision-making process. Click here to learn about sustainable investing companies.