Unlock ESG Ethical & Responsible Investing

Understanding ESG Investing: More Than Just a Trend

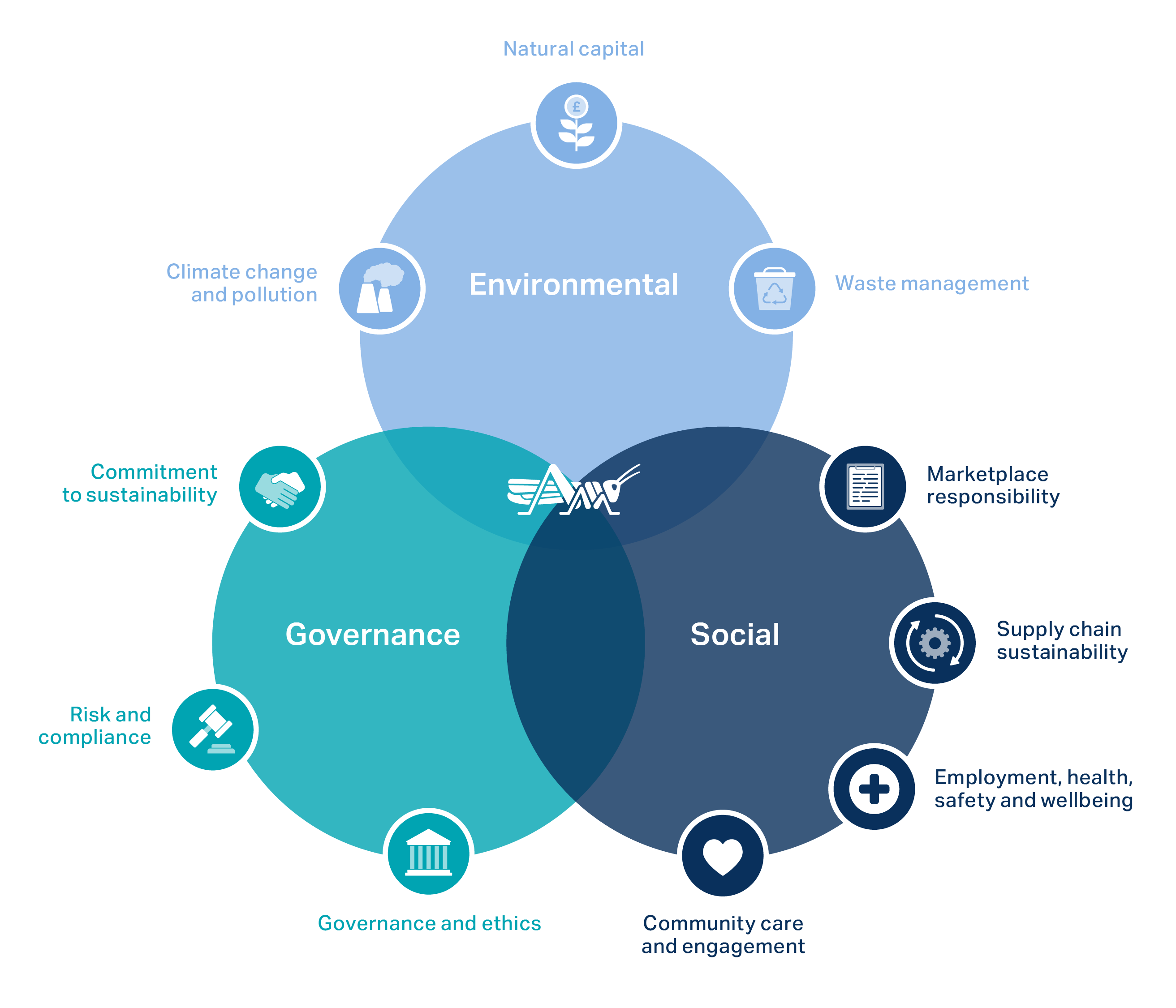

Environmental, Social, and Governance (ESG) investing isn’t just a fleeting fad; it’s a rapidly evolving approach to investing that considers a company’s impact on the world alongside its financial performance. It’s about recognizing that a company’s long-term success isn’t solely determined by its profit margins, but also by its commitment to environmental sustainability, its treatment of employees and stakeholders, and its adherence to strong governance principles. Investors are increasingly realizing that these factors are intrinsically linked to financial resilience and long-term value creation.

The Environmental Pillar: Protecting Our Planet

The ‘E’ in ESG stands for Environmental. This aspect focuses on a company’s impact on the environment, considering factors like its carbon footprint, water usage, waste management, and commitment to renewable energy. Companies with strong environmental practices are often better positioned to navigate the transition to a low-carbon economy and avoid potential regulatory penalties. Investors are increasingly demanding transparency and accountability from companies regarding their environmental performance, leading to a surge in the demand for sustainable and environmentally conscious investments.

The Social Pillar: People Matter

The ‘S’ represents Social factors, which encompass a company’s relationships with its employees, customers, suppliers, and the wider community. This includes aspects like labor standards, diversity and inclusion, human rights, data privacy, and product safety. Companies that treat their employees fairly, foster diverse and inclusive work environments, and prioritize ethical sourcing are generally seen as more resilient and better positioned for long-term success. Investors are increasingly recognizing the importance of social responsibility in creating a more equitable and just society.

The Governance Pillar: Transparency and Accountability

Governance (‘G’) focuses on a company’s leadership, executive pay, audit and risk management practices, and shareholder rights. Strong corporate governance ensures transparency, accountability, and ethical decision-making. Companies with robust governance structures tend to be less prone to scandals and legal issues, which can negatively impact their financial performance. Investors prioritize companies with strong governance structures as they demonstrate a commitment to responsible management and long-term value creation.

How ESG Investing Benefits Investors

Integrating ESG factors into investment decisions can lead to various benefits for investors. Studies have shown that companies with strong ESG profiles often outperform their counterparts over the long term. This is because companies with a commitment to sustainability, social responsibility, and good governance tend to be more resilient, innovative, and better able to manage risks. Moreover, ESG investing aligns investments with personal values, offering a sense of purpose beyond financial returns.

Identifying ESG-Focused Investments

Finding ESG-focused investments is becoming increasingly easier. Many investment firms now offer dedicated ESG funds and portfolios. However, it’s essential to do your research and understand the specific ESG criteria used by different investment managers. Some funds may focus on specific ESG themes, such as renewable energy or sustainable agriculture, while others may adopt a broader, integrated approach. Look for funds with transparent methodologies and clear reporting on their ESG performance.

Navigating the Complexity of ESG Ratings and Data

The ESG landscape is evolving rapidly, and the data used to assess a company’s ESG performance can vary significantly across different providers. This can make it challenging to compare companies and make informed investment decisions. It’s important to understand the methodologies used by different rating agencies and to consider multiple data sources when evaluating a company’s ESG performance. Remember that ESG ratings are just one piece of the puzzle and should be considered alongside traditional financial analysis.

The Future of ESG Investing: Continued Growth and Evolution

ESG investing is poised for continued growth in the coming years. As awareness of climate change and other environmental and social issues grows, more investors will demand greater transparency and accountability from companies. Regulatory changes are also likely to play a significant role in shaping the future of ESG investing. Investors can expect to see increased standardization of ESG data and reporting, as well as more stringent regulations related to environmental and social issues.

Beyond Financial Returns: The Impact of Ethical Investing

ESG investing is not just about achieving financial returns; it’s about aligning investments with personal values and contributing to a more sustainable and equitable future. By investing in companies that prioritize environmental sustainability, social responsibility, and strong governance, investors can have a positive impact on the world while also generating financial returns. It represents a shift towards a more holistic and responsible approach to investing, where financial performance is considered alongside broader societal and environmental impacts. Read also about ESG investing meaning.

ESG Investing A Better Future for Your Money

What is ESG Investing?

ESG investing, short for Environmental, Social, and Governance investing, is an approach to investing that considers a company’s impact on the environment, its social responsibility, and its corporate governance practices. It’s not about sacrificing returns for values; instead, it’s about integrating these factors into investment decisions to identify companies that are better positioned for long-term success. These companies tend to be more resilient to risks and better positioned to capitalize on emerging opportunities. It’s about looking beyond traditional financial metrics to assess a more holistic picture of a company’s viability and potential.

Environmental Factors: A Planet-Conscious Approach

The environmental aspect of ESG investing focuses on a company’s impact on the planet. This includes things like its carbon footprint, waste management practices, water usage, and commitment to renewable energy. Companies with strong environmental performance are often better equipped to navigate evolving environmental regulations and benefit from the growing demand for sustainable products and services. Investors are increasingly seeking out companies actively working to reduce their environmental impact, contributing to a greener future while potentially boosting their investment portfolio.

Social Responsibility: People Matter

The social component of ESG considers how a company treats its employees, customers, suppliers, and the wider community. This encompasses aspects like labor practices, diversity and inclusion, data privacy, product safety, and community engagement. Companies with strong social performance are often viewed favorably by consumers and attract and retain top talent. Investing in socially responsible companies can align your investments with your personal values while potentially reducing reputational risk associated with unethical business practices.

Governance: Strong Foundations for Success

Governance refers to a company’s leadership structure, executive compensation, auditing practices, and overall transparency. Strong corporate governance promotes accountability and reduces the risk of fraud and corruption. Companies with effective governance structures tend to be more stable and reliable long-term investments. This aspect of ESG investing is crucial as it lays the foundation for ethical and sustainable business operations.

How ESG Investing Benefits You

ESG investing offers numerous benefits beyond simply aligning your investments with your values. Studies suggest that ESG companies may outperform their non-ESG counterparts over the long term. This is because companies with strong ESG profiles often demonstrate better risk management, innovation, and long-term planning. By focusing on ESG factors, investors can potentially reduce their exposure to financial risks associated with environmental damage, social unrest, or poor corporate governance. Furthermore, it allows investors to contribute towards positive social and environmental change.

Finding ESG Investments: Practical Steps

Integrating ESG into your investment strategy can be easier than you think. Many brokerage firms and investment platforms offer ESG-focused funds, ETFs (Exchange-Traded Funds), and individual stock screenings. You can also research companies directly using publicly available ESG ratings and reports from various organizations. Remember to carefully consider your risk tolerance and investment goals when choosing ESG investments. It’s always wise to diversify your portfolio to manage risk effectively, even within the ESG space.

Beyond the Numbers: A Holistic Approach

ESG investing isn’t just about numbers; it’s about considering the broader impact of your investments. By considering environmental, social, and governance factors, you’re not just making a financial decision; you’re actively participating in creating a more sustainable and equitable future. It encourages companies to improve their practices, driving positive change across various industries and contributing to a more responsible global economy. This holistic perspective offers both financial and ethical returns, providing a compelling reason for integrating ESG into your investment strategy.

The Future of Finance: ESG’s Growing Influence

ESG investing is rapidly gaining momentum, driven by increasing investor demand, stricter regulations, and a growing awareness of the interconnectedness between business and society. As the world grapples with climate change, social inequality, and other global challenges, ESG is becoming increasingly crucial for long-term investment success. By incorporating ESG factors into your investment decisions, you’re positioning yourself for success in a world that increasingly values sustainability and social responsibility. Please click here to learn more about sustainable investing and ESG.

Ethical Investing Grow Your Money Responsibly

What is Ethical Investing?

Ethical investing, also known as sustainable, responsible, or impact investing, is an approach to investing that considers not only financial returns but also the social and environmental impact of the companies you invest in. It’s about aligning your investments with your values, supporting businesses that are committed to positive change, and avoiding those that contribute to harm. This could mean prioritizing companies with strong environmental, social, and governance (ESG) performance or excluding those involved in controversial industries like fossil fuels, weapons manufacturing, or tobacco.

Why Choose Ethical Investing?

For many, the reasons for choosing ethical investing extend beyond simply generating a return. It’s a way to make a tangible difference in the world. By investing in companies with strong ESG profiles, you’re essentially voting with your money, supporting businesses that are striving to create a more sustainable and equitable future. It also offers a sense of personal satisfaction knowing your investments are aligned with your values, contributing to a better world while building your financial future. Furthermore, some studies suggest that ethical investments can perform just as well, or even better, than traditional investments in the long run, mitigating some of the risks associated with companies with poor ESG performance.

Different Approaches to Ethical Investing

There are various approaches to ethical investing, offering different levels of engagement and scrutiny. Some investors choose to screen out companies involved in specific industries they find objectionable. Others might focus on positive screening, actively selecting companies that demonstrate strong ESG performance. Impact investing goes a step further, aiming to generate measurable social or environmental impact alongside financial returns. Finally, shareholder activism involves engaging directly with companies to encourage positive change in their practices. The best approach will depend on your personal values and investment goals.

ESG Factors: The Cornerstones of Ethical Investing

Environmental, Social, and Governance (ESG) factors are at the heart of ethical investing. Environmental factors consider a company’s impact on the planet, including its carbon footprint, waste management, and resource consumption. Social factors examine how a company treats its employees, customers, and the wider community, looking at issues like labor practices, human rights, and diversity. Governance factors assess a company’s leadership, transparency, and ethical conduct, including board composition, executive compensation, and corruption prevention.

Finding Ethical Investment Opportunities

Finding suitable ethical investments is easier than ever before. Many investment firms now offer ESG-focused funds and portfolios, providing diversified exposure to companies with strong ESG profiles. Online resources and rating agencies offer information on the ESG performance of individual companies, allowing you to research and make informed decisions. You can also consult with a financial advisor specializing in sustainable and responsible investing to help you navigate the options and create a personalized investment plan.

The Importance of Due Diligence

While ethical investing offers significant benefits, it’s crucial to conduct thorough due diligence before making any investment decisions. Not all companies claiming to be “ethical” actually live up to their claims, so it’s essential to critically examine the evidence and understand the nuances of ESG ratings and reporting. Look beyond marketing materials and delve into a company’s sustainability reports, independent audits, and news coverage to get a comprehensive picture of its performance.

Beyond the Investments: Making a Broader Impact

Ethical investing is more than just choosing the “right” companies; it’s about embracing a broader perspective on your financial life and how it intersects with your values. Consider your spending habits alongside your investments. Supporting businesses that align with your ethics in your day-to-day life amplifies the impact of your ethical investing strategy. This holistic approach ensures that your financial choices reflect your values consistently and effectively.

Long-Term Perspective and Patience

Ethical investing is a long-term strategy. Don’t expect overnight riches or immediate, drastic changes. The positive impacts of ethical investing often unfold over time, and financial returns may not always outperform traditional investments in the short term. However, by adopting a patient, long-term view, you contribute to building a more sustainable and equitable world while working towards your own financial goals. This requires patience and a commitment to consistent, responsible investing practices. Read also about ESG investing stocks.

Green Investing Your Guide to a Sustainable Future

Understanding Green Investing

Green investing, also known as sustainable or responsible investing, involves putting your money into companies and projects that prioritize environmental sustainability and social responsibility. This isn’t just about feeling good; it’s about recognizing that environmental and social factors directly impact a company’s long-term success and profitability. A company that damages the environment or mistreats its workforce faces higher risks and potentially lower returns in the long run. Green investing aims to identify and support businesses actively mitigating these risks.

Different Approaches to Green Investing

There are several ways to incorporate green principles into your investment strategy. You could choose to invest directly in companies that are leaders in renewable energy, sustainable agriculture, or green technology. Alternatively, you could invest in funds or ETFs (exchange-traded funds) that specifically focus on environmentally and socially responsible companies. These funds often use screening criteria to exclude companies involved in activities like fossil fuels, deforestation, or weapons manufacturing, while prioritizing those with strong environmental, social, and governance (ESG) ratings. Finally, you can engage in impact investing, where the primary goal is to generate positive social and environmental impact alongside financial returns.

Identifying Green Companies and Funds

Finding genuinely green investments requires careful research. Look for companies with publicly available sustainability reports, detailing their environmental performance, social initiatives, and governance practices. Independent rating agencies like MSCI and Sustainalytics provide ESG ratings that can help you assess a company’s commitment to sustainability. Similarly, when choosing funds, examine their investment strategies and portfolio holdings. Look for funds that clearly articulate their ESG criteria and regularly report on their impact. Don’t rely solely on marketing materials; delve deeper into the underlying data and methodologies.

The Role of ESG Factors

Environmental, Social, and Governance (ESG) factors are at the heart of green investing. Environmental factors consider a company’s impact on the environment, including its carbon footprint, waste management, and resource consumption. Social factors encompass its treatment of employees, suppliers, and the communities where it operates. Governance refers to its corporate structure, ethical practices, and transparency. Analyzing these factors helps investors assess a company’s long-term sustainability and potential risks, allowing for more informed investment decisions. Strong ESG performance is often correlated with better financial performance.

Beyond the Bottom Line: Social Impact

Green investing isn’t solely about financial returns; it’s also about contributing to a more sustainable and equitable future. By supporting companies that prioritize environmental protection and social justice, you’re aligning your investments with your values. Many green investments directly contribute to positive social change, such as clean energy initiatives that reduce carbon emissions or sustainable agriculture practices that protect biodiversity. This positive impact can be both personally fulfilling and contribute to a broader shift towards a more sustainable global economy.

Risks and Considerations in Green Investing

While green investing offers significant potential, it’s essential to acknowledge the risks. The green sector is still developing, and some green companies might not be as financially stable as established companies in other sectors. Furthermore, the definition of “green” can be subjective, and “greenwashing” – the practice of falsely portraying a company as environmentally friendly – is a concern. Thorough due diligence and a well-diversified portfolio are crucial to mitigate these risks. It’s also important to remember that returns in green investments might not always be immediate or higher than traditional investments. The focus should be on the long-term, sustainable growth potential.

Getting Started with Green Investing

Begin by assessing your personal investment goals and risk tolerance. Consider your values and how they align with different investment approaches. If you’re unsure where to start, consult a financial advisor who specializes in sustainable investing. Many brokerage firms now offer a range of green investment options, including ESG funds and impact investing opportunities. Start small, gradually incorporating green investments into your portfolio, and continuously monitor your investments to ensure they align with your evolving goals and values. Remember, sustainable investing is a journey, not a destination.

The Future of Green Investing

Green investing is no longer a niche strategy; it’s becoming increasingly mainstream. As awareness of climate change and social issues grows, more investors are demanding transparency and accountability from companies. Government regulations and international agreements are also driving the shift towards a more sustainable economy. This trend is likely to continue, making green investing not just an ethical choice but also a smart long-term financial decision. The future of finance is undeniably intertwined with the future of the planet, making green investing a crucial component of responsible investing for years to come. Click here to learn about a sustainable investing strategy.

Sustainable Investing Making Money & a Difference

What is Sustainable Investing?

Sustainable investing, also known as responsible investing or ESG (environmental, social, and governance) investing, goes beyond simply seeking financial returns. It integrates environmental, social, and governance factors into investment decisions. This means considering a company’s impact on the planet, its treatment of its workers and community, and its corporate governance practices alongside traditional financial metrics. It’s about aligning your investments with your values and contributing to a more sustainable future.

The Financial Case for Sustainable Investing

Many believe sustainable investing sacrifices profitability for ethical considerations. However, a growing body of research suggests that integrating ESG factors can actually enhance long-term financial performance. Companies with strong ESG profiles often demonstrate better risk management, innovation, and long-term resilience. They tend to attract and retain top talent, build stronger customer relationships, and face fewer regulatory and reputational risks. This translates into potentially higher returns and reduced volatility over time.

Identifying Sustainable Investments

Finding suitable sustainable investments can be easier than you think. Many asset managers now offer dedicated sustainable investment funds, ranging from equity and fixed-income portfolios to alternative investments. Look for funds that clearly outline their ESG criteria and investment strategies. Independent ratings agencies also provide ESG scores for companies, helping you assess their sustainability performance. It’s wise to engage with your financial advisor to identify investments aligned with your personal risk tolerance and ethical priorities.

Different Approaches to Sustainable Investing

There’s a spectrum of approaches within sustainable investing. Some investors focus on negative screening, avoiding companies involved in specific harmful activities like fossil fuels or tobacco. Others adopt positive screening, actively seeking out companies with strong ESG profiles. Impact investing aims to generate measurable social and environmental impact alongside financial returns. Finally, shareholder engagement involves actively engaging with companies to encourage them to adopt more sustainable practices.

Minimizing Greenwashing

It’s crucial to be wary of “greenwashing,” where companies exaggerate their sustainability credentials to attract investors. Do your due diligence. Scrutinize a company’s sustainability reports, looking for specific, measurable, achievable, relevant, and time-bound (SMART) goals. Independent verification of ESG data is a strong indicator of authenticity. Look for companies that transparently disclose their environmental and social footprint, as well as their governance structure.

Beyond Financial Returns: The Social Impact

The benefits of sustainable investing extend beyond personal finance. By investing in companies committed to sustainability, you’re directly contributing to positive change. Your investment dollars can support the transition to a cleaner energy future, promote social equity, and improve corporate governance practices. This has a ripple effect, fostering innovation, creating jobs in emerging green sectors, and improving the overall well-being of communities and the planet.

Getting Started with Sustainable Investing

Starting your sustainable investing journey is simpler than you might imagine. You can begin by gradually shifting a portion of your portfolio towards sustainable investments. Many brokerage accounts offer tools and resources to screen for ESG-focused companies and funds. Talk to your financial advisor to incorporate sustainable investing into your overall financial plan, ensuring it aligns with your risk tolerance and financial goals. Remember, even small changes can make a big difference.

The Future of Sustainable Investing

The sustainable investing landscape is constantly evolving. Increasing regulatory pressure, growing consumer demand for ethical products and services, and a rising awareness of climate change are driving more capital towards sustainable investments. As the field matures, we can expect greater standardization of ESG data, more sophisticated investment strategies, and even more compelling evidence of the link between sustainability and financial performance. The future looks bright for those seeking both financial returns and positive social and environmental impact. Read also about ESG sustainable investing.