Banking’s Digital Revolution A Fintech Story

The Rise of Fintech and its Disruptive Impact

The financial services industry, long known for its traditional brick-and-mortar approach, has undergone a seismic shift in recent years. Fintech, a portmanteau of “financial technology,” has emerged as a powerful force, disrupting established banking models and offering consumers and businesses alike a new breed of financial services. This disruption isn’t just about shiny new apps; it represents a fundamental change in how we interact with money, manage our finances, and access credit.

Mobile Banking: The Pocket-Sized Revolution

One of the most visible facets of the digital banking revolution is the rise of mobile banking. Smartphones have become ubiquitous, and with them, the ability to manage finances on the go. From checking balances and transferring funds to paying bills and investing, mobile banking apps offer unparalleled convenience. This accessibility has democratized financial services, extending reach to underserved populations and empowering individuals with greater control over their money.

The Power of Payments: Faster, Cheaper, and More Convenient

The digital transformation has significantly impacted the payments landscape. Traditional methods like checks and wire transfers are gradually being replaced by faster, cheaper, and more secure alternatives such as mobile payments (Apple Pay, Google Pay), peer-to-peer (P2P) transfers (Venmo, Zelle), and real-time payment systems. This shift has increased efficiency, reduced transaction costs, and improved the overall customer experience. The speed and ease of digital payments are reshaping consumer behavior and driving innovation across the industry.

Digital Lending: Expanding Access to Credit

Access to credit has historically been a challenge for many, particularly small businesses and individuals with limited credit history. Fintech companies are leveraging data analytics and alternative credit scoring methods to expand access to credit. Online lending platforms offer faster approval times and simpler application processes compared to traditional banks. This innovation is particularly impactful in underserved communities, promoting financial inclusion and economic empowerment.

Personalized Financial Management: AI and Algorithmic Advice

Artificial intelligence (AI) and machine learning are transforming the way individuals manage their finances. Fintech platforms are using sophisticated algorithms to analyze spending patterns, predict future financial needs, and offer personalized financial advice. Robo-advisors, automated investment platforms, offer low-cost portfolio management solutions tailored to individual risk tolerance and financial goals. This personalized approach democratizes access to sophisticated financial advice, empowering individuals to make informed financial decisions.

Blockchain and Cryptocurrencies: Shaping the Future of Finance

While still in its nascent stages, the integration of blockchain technology and cryptocurrencies is poised to significantly disrupt the financial landscape. Blockchain’s secure and transparent nature offers the potential to streamline transactions, enhance security, and reduce the reliance on intermediaries. Cryptocurrencies, though volatile, represent a potential alternative to traditional fiat currencies, challenging established financial systems and opening up new possibilities for cross-border payments and decentralized finance (DeFi).

Cybersecurity and Data Privacy: Navigating the Risks

The digital revolution in banking brings with it significant cybersecurity risks and data privacy concerns. With increased reliance on digital platforms and the handling of sensitive financial data, banks and fintech companies must prioritize robust security measures to protect customer information and prevent fraud. Data breaches and cyberattacks can have devastating consequences, highlighting the importance of ongoing investment in cybersecurity infrastructure and best practices.

Regulation and Innovation: Striking a Balance

As the fintech industry rapidly evolves, regulators face the challenge of balancing innovation with the need for consumer protection and financial stability. The regulatory landscape is constantly adapting to the emergence of new technologies and business models. Finding the right balance between fostering innovation and mitigating risks is crucial for ensuring the sustainable growth of the digital banking revolution and protecting consumers.

The Future of Banking: A Collaborative Ecosystem

The future of banking is likely to be defined by collaboration between traditional banks and fintech companies. Banks can leverage the agility and innovation of fintech startups to enhance their existing offerings and reach new customer segments. Fintech companies, in turn, can benefit from the established infrastructure and regulatory compliance of traditional banks. This synergistic relationship will likely drive further innovation and reshape the banking landscape in the years to come. Click here to learn about the fintech disruption of the banking industry.

Fintech’s Bank Revolution What’s Changing?

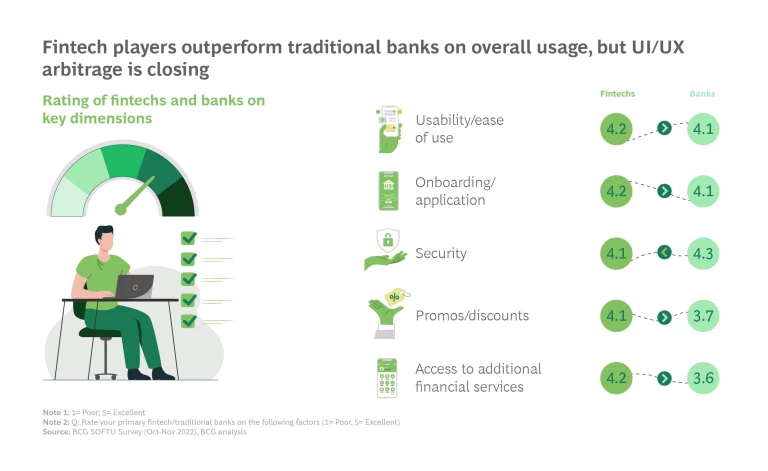

The Rise of Mobile Banking and its Impact

Gone are the days of lengthy queues at bank branches. Mobile banking apps have revolutionized how we interact with our finances. From checking balances and transferring funds to paying bills and investing, most banking tasks are now accessible with a few taps on our smartphones. This convenience has dramatically increased financial inclusion, particularly for underserved populations who might not have easy access to physical bank branches. The seamless integration of mobile banking with other financial services, such as payment apps and budgeting tools, further streamlines financial management. The speed and efficiency offered by mobile banking are arguably its most compelling features, saving users valuable time and effort.

The Disruption Caused by Neobanks

Neobanks, digital-only banks without physical branches, are disrupting the traditional banking landscape. They offer streamlined account opening processes, often leveraging technology like AI and machine learning for faster verification and approval. These banks often boast lower fees and more transparent pricing structures compared to traditional institutions, attracting a younger, tech-savvy demographic. Neobanks are also leading the way in personalized financial management tools, offering features like budgeting assistance, savings goals, and automated investment options. This customer-centric approach and agile technological innovation are key factors in their rapid growth and appeal.

The Power of Open Banking and Data Sharing

Open banking, which allows customers to share their financial data with third-party providers, is transforming the financial ecosystem. This data sharing empowers individuals to gain a clearer picture of their overall financial health, enabling better decision-making. It also fosters innovation by providing fintech companies with the data they need to develop more personalized and effective financial products and services. From sophisticated budgeting apps to customized investment strategies, the possibilities opened up by open banking are vast. However, concerns around data security and privacy remain crucial considerations.

AI and Machine Learning’s Influence on Personalized Finance

Artificial intelligence (AI) and machine learning (ML) are rapidly becoming indispensable tools in the fintech industry. These technologies are used to personalize financial advice, detect fraud, and automate various banking processes. AI-powered chatbots are providing 24/7 customer support, answering queries, and resolving issues efficiently. ML algorithms are analyzing vast amounts of data to predict customer behavior, assess creditworthiness, and personalize financial product offerings. This level of personalization tailors financial services to individual needs more effectively than ever before, enhancing customer experience and driving innovation.

Blockchain Technology and Decentralized Finance (DeFi)

Blockchain technology, the foundation of cryptocurrencies, is also making its mark on the traditional financial system. Decentralized finance (DeFi) applications built on blockchain offer alternatives to traditional financial services, such as lending, borrowing, and investing. These platforms often operate without intermediaries, potentially reducing costs and increasing transparency. While still relatively nascent, DeFi holds immense potential to reshape the financial landscape, offering greater financial accessibility and control to individuals. However, the inherent volatility and regulatory uncertainties surrounding cryptocurrencies present significant challenges.

The Growing Importance of Cybersecurity

As more financial transactions move online, cybersecurity becomes paramount. Fintech companies are investing heavily in robust security measures to protect sensitive customer data from cyber threats. This includes advanced encryption technologies, multi-factor authentication, and real-time fraud detection systems. Collaboration between fintech companies, regulators, and cybersecurity experts is crucial to mitigate risks and maintain public trust in the digital financial ecosystem. The constant evolution of cyber threats necessitates continuous adaptation and innovation in security protocols.

The Future of Fintech and the Banking Industry

The integration of fintech and traditional banking is becoming increasingly intertwined. Traditional banks are adopting innovative fintech solutions to improve their offerings and remain competitive. Fintech companies are also partnering with established banks to expand their reach and access to resources. This symbiotic relationship is likely to continue driving innovation and reshaping the future of the financial services industry, leading to a more efficient, accessible, and personalized financial ecosystem for everyone. Please click here to learn about fintech disruption in banking.

Beyond Banks Fintech’s Innovative Solutions

Beyond Banks’ Rise in the Fintech Arena

Beyond Banks isn’t just another fintech; it’s a disruptive force reshaping the financial landscape. Their innovative approach focuses on providing tailored solutions that address the shortcomings of traditional banking systems. They’ve carved a niche by understanding the evolving needs of both businesses and consumers, offering services that are often more efficient, transparent, and accessible than those offered by established institutions. This commitment to innovation is evident in their diverse product portfolio and strategic partnerships.

Streamlining Business Lending with AI-Powered Platforms

One of Beyond Banks’ key strengths lies in its intelligent lending platforms. Leveraging the power of artificial intelligence and machine learning, they’ve created systems that can assess loan applications with unprecedented speed and accuracy. This automated process significantly reduces the time it takes for businesses to secure funding, allowing them to focus on growth rather than administrative hurdles. The AI algorithms analyze a broad range of data points, providing a more holistic view of a business’s creditworthiness than traditional methods, resulting in fairer and more informed lending decisions. This technology also helps minimize the risk for Beyond Banks, leading to more sustainable and accessible lending practices.

Empowering Consumers with Personalized Financial Management Tools

Beyond Banks recognizes that personal finance can be daunting. To simplify this, they’ve developed user-friendly mobile applications and online platforms that empower individuals to manage their finances effectively. These tools provide personalized insights and budgeting assistance, helping users track their spending, set financial goals, and make informed decisions about their money. Features like automated savings plans and real-time transaction alerts provide a level of control and transparency that’s often lacking in traditional banking. This consumer-centric approach has helped Beyond Banks cultivate a loyal customer base that appreciates their commitment to ease of use and financial empowerment.

Blockchain Technology for Secure and Transparent Transactions

Recognizing the potential of blockchain technology, Beyond Banks has integrated it into several of its services. This enhances security and transparency for both businesses and consumers. By utilizing blockchain’s immutable ledger, transactions are recorded securely and are virtually tamper-proof. This increased transparency builds trust and improves accountability, addressing concerns about data privacy and security that are prevalent in the traditional banking system. Beyond Banks’ adoption of this cutting-edge technology positions them as a leader in the fintech space, committed to leveraging the best available technologies to improve financial services.

Strategic Partnerships for Enhanced Reach and Functionality

Beyond Banks understands the power of collaboration. They’ve forged strategic partnerships with various organizations to expand their reach and enhance their service offerings. These partnerships range from collaborations with payment processors to integrations with accounting software providers. By working with complementary businesses, Beyond Banks can offer a more comprehensive and integrated financial ecosystem, providing users with a seamless and unified experience. This approach not only strengthens their market position but also demonstrates their commitment to providing holistic financial solutions.

Data Analytics and Personalized Financial Advice

Beyond Banks’ commitment to data-driven decision-making is integral to their success. They leverage advanced analytics to gain deep insights into user behavior and financial trends. This data informs their product development, helping them anticipate future needs and tailor their services to meet specific demands. Moreover, the data collected allows them to provide personalized financial advice, guiding users towards achieving their financial goals more effectively. This proactive approach to financial management sets them apart from competitors, offering a more personalized and valuable service.

Regulatory Compliance and Ethical Practices

Beyond Banks operates with a strong commitment to regulatory compliance and ethical practices. They understand the importance of maintaining the trust of their customers and upholding the highest standards of conduct. Their commitment to transparency and responsible lending practices is reflected in their operations and ensures they remain a reliable and trustworthy financial partner. This dedication to ethical business practices is crucial in building long-term relationships with customers and maintaining a positive reputation within the industry.

Future Innovations and Expansion Plans

Beyond Banks is not resting on its laurels. They’re constantly exploring new technologies and innovative solutions to further enhance their services. Their ambitious expansion plans involve reaching new markets and introducing new products that continue to disrupt the traditional financial sector. This forward-thinking approach ensures Beyond Banks will remain at the forefront of fintech innovation, shaping the future of finance for businesses and individuals alike. Read also about [fintech disruption of financial services](https://buenosjuegosgratis.com)

Fintech’s Big Shakeup What’s Changing Money?

The Rise of Embedded Finance

The way we interact with financial services is undergoing a dramatic shift. Embedded finance is rapidly changing the landscape, seamlessly integrating financial products into non-financial platforms. Imagine ordering groceries and effortlessly securing a loan for the purchase through the same app, or booking a vacation and automatically securing travel insurance. This seamless integration removes friction and increases accessibility, making financial services far more convenient for the average consumer. It’s a win-win, as businesses can offer additional revenue streams and users gain a more streamlined experience.

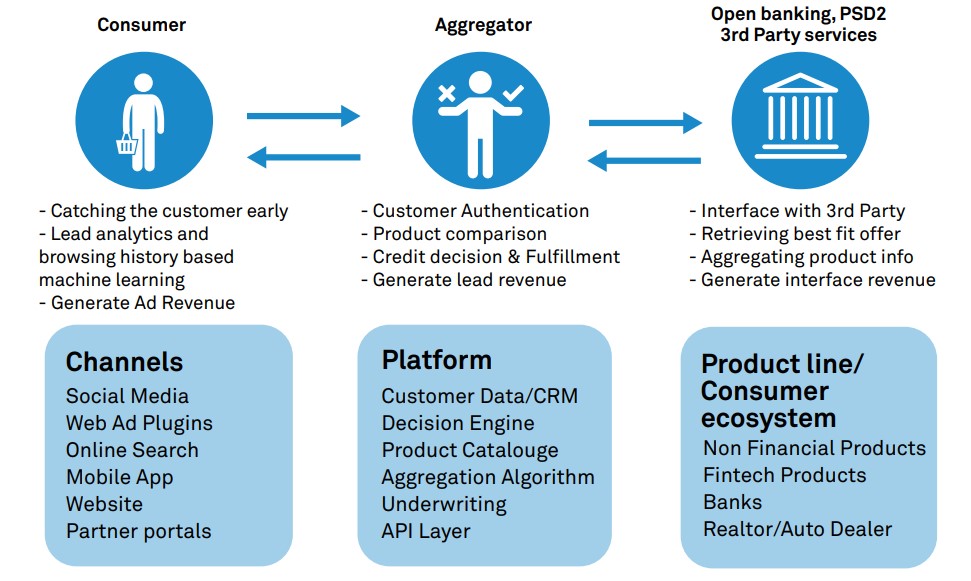

The Power of Open Banking and APIs

Open banking APIs are revolutionizing how data is shared and utilized within the financial ecosystem. This allows third-party developers to create innovative applications using authorized customer data, fostering competition and enhancing personalized financial solutions. Imagine personalized budgeting apps that connect to all your accounts, offering proactive insights and recommendations, or robo-advisors that dynamically adjust your investment strategy based on real-time market changes and your spending habits. The possibilities are truly endless and the increased competition drives innovation and better services for the end-user.

The Explosion of Digital Payments

Gone are the days of solely relying on cash and checks. Digital payment methods are now the dominant force, driven by the widespread adoption of smartphones and the development of secure, user-friendly payment platforms. From mobile wallets like Apple Pay and Google Pay to peer-to-peer payment apps like Venmo and Zelle, the ease and speed of digital transactions have drastically altered how we handle money in our daily lives. This has implications for traditional banking institutions, who are adapting to this shift to maintain relevance and customer loyalty in the increasingly competitive market.

The Growing Influence of Blockchain and Cryptocurrency

While still in its relative infancy, blockchain technology is poised to significantly disrupt the financial industry. Its secure and transparent nature offers the potential to streamline processes, reduce costs, and enhance security in areas such as cross-border payments and supply chain finance. Cryptocurrencies, although volatile, continue to gain traction as an alternative investment asset and payment method, forcing established financial institutions to explore and understand this new landscape, whether they embrace it or not. The impact of both on the long-term financial future is still evolving but significant changes are certainly coming.

The Rise of AI and Machine Learning in Fintech

Artificial intelligence and machine learning are transforming how financial services are delivered. These technologies are used in fraud detection, risk assessment, algorithmic trading, and personalized financial advice. AI-powered chatbots provide instant customer support, while sophisticated algorithms analyze vast datasets to identify trends and predict future market movements. This increased automation and data analysis leads to more efficient and personalized services, benefitting both businesses and consumers. It’s a crucial component of improving the user experience and making finance more accessible.

The Increasing Importance of Cybersecurity

With the rapid growth of digital financial services, cybersecurity has become paramount. Protecting sensitive financial data from cyber threats is crucial to maintaining trust and preventing financial losses. Fintech companies are investing heavily in advanced security measures, employing robust encryption techniques, and implementing multi-factor authentication to safeguard user information. This ongoing battle between security innovators and cybercriminals highlights the importance of maintaining vigilance and prioritizing security in every aspect of the evolving digital financial system.

The Democratization of Financial Services

Fintech’s disruptive power is particularly significant in making financial services more accessible to underserved populations. Mobile money platforms, micro-lending services, and digital banking solutions are bridging the gap for individuals previously excluded from traditional banking systems. This increased access to financial services has the potential to improve financial inclusion, empower individuals, and drive economic growth, ultimately creating a more equitable financial system worldwide. It also opens a huge market for Fintech companies eager to tap into previously unserved populations.

Regulatory Challenges and Adaptations

The rapid pace of innovation in fintech poses significant challenges for regulators. Keeping up with the latest technological advancements and ensuring the safety and stability of the financial system necessitates a dynamic and adaptive regulatory framework. Governments and regulatory bodies worldwide are grappling with the complexities of balancing innovation with consumer protection and maintaining financial stability. This ongoing dialogue between regulators and fintech companies is crucial to fostering responsible innovation and ensuring a sustainable and secure financial future. Read more about what is fintech disruption.

Lending’s Revolution Fintech’s Latest Shakeup

The Rise of Fintech Lending and its Disruptive Power

The lending landscape has undergone a seismic shift in recent years, largely driven by the innovative force of Fintech companies. These agile businesses, unburdened by the legacy systems and bureaucratic inertia of traditional banks, have rapidly redefined how individuals and businesses access credit. They’ve leveraged technology to streamline processes, reduce costs, and broaden access to a wider pool of borrowers, ultimately making credit more available and, in many cases, more affordable.

Fintech’s Technological Edge: Speed, Efficiency, and Accessibility

Fintech lenders utilize sophisticated algorithms and data analytics to assess creditworthiness far quicker than traditional institutions. This speed translates into faster loan approvals and disbursements, a crucial factor for borrowers facing urgent financial needs. Furthermore, their online platforms offer a seamless, 24/7 accessible borrowing experience, eliminating the need for physical visits to branches and lengthy paperwork. This accessibility is particularly beneficial for underserved communities and those in geographically remote areas.

The Data-Driven Approach: A Double-Edged Sword

Fintech’s reliance on data analysis is both a strength and a potential weakness. While it enables them to make faster and potentially more accurate credit assessments, it also raises concerns about data privacy and potential biases embedded within algorithms. The use of alternative data sources, such as social media activity and online spending habits, opens doors to broader credit access but also necessitates careful consideration of ethical implications and regulatory compliance.

The Latest Fintech Lending Shakeup: Increased Competition and Consolidation

The Fintech lending sector is currently experiencing a period of rapid growth and intense competition. This has led to a flurry of mergers and acquisitions, as larger players seek to consolidate their market share and expand their product offerings. Smaller players are facing pressure to innovate and differentiate themselves in order to survive in this increasingly crowded marketplace. This consolidation, while creating stronger entities, might also potentially limit the diversity of offerings and increase the overall market power of a few major players.

Navigating Regulatory Hurdles and Maintaining Trust

The rapid expansion of Fintech lending has also brought increased regulatory scrutiny. Governments worldwide are grappling with how to effectively regulate this dynamic sector while fostering innovation and protecting consumers. Building and maintaining trust is crucial for Fintech lenders, as concerns about data security, predatory lending practices, and transparency remain prevalent. Addressing these concerns through robust internal controls and transparent practices is vital for long-term success.

The Future of Fintech Lending: AI, Open Banking, and Beyond

The future of Fintech lending is likely to be shaped by advancements in artificial intelligence (AI), open banking, and blockchain technology. AI is expected to further refine credit scoring models, personalize loan offerings, and automate processes even more efficiently. Open banking will facilitate seamless data sharing between lenders and borrowers, potentially leading to more competitive rates and improved customer experiences. Blockchain technology may enhance transparency and security in loan transactions, reducing fraud and simplifying documentation.

The Impact on Traditional Banking

The rise of Fintech lending is forcing traditional banks to adapt and innovate. Many established institutions are now investing heavily in their own digital lending platforms and exploring partnerships with Fintech companies to enhance their capabilities. The pressure to compete is pushing banks to improve their customer service, streamline their processes, and offer more competitive rates and products. This competition ultimately benefits consumers with a wider variety of choices and improved overall services.

Challenges and Opportunities Remain

Despite the transformative impact of Fintech lending, significant challenges remain. Ensuring responsible lending practices, addressing biases in algorithmic decision-making, and protecting consumer data are paramount. However, the opportunities are equally immense. Fintech lending has the potential to unlock access to credit for millions of underserved individuals and businesses, driving economic growth and financial inclusion on a global scale. The sector’s evolution will continue to be a dynamic and exciting journey, constantly adapting to technological advancements and evolving regulatory landscapes. Please click here to learn about fintech disruption in lending.

Fintech’s Revolution Reshaping Asset Management

The Rise of Robo-Advisors and Algorithmic Trading

The asset management industry is undergoing a dramatic transformation, largely driven by the rapid advancements in financial technology, or Fintech. One of the most visible changes is the rise of robo-advisors. These automated platforms utilize algorithms to provide portfolio management services at a fraction of the cost of traditional human advisors. This accessibility has opened up investing to a much wider audience, particularly those with smaller portfolios who previously couldn’t afford professional management. Simultaneously, algorithmic trading is becoming increasingly sophisticated, allowing for faster execution speeds and the identification of subtle market inefficiencies that human traders might miss. This technology is not only changing how trades are executed but also influencing investment strategies themselves.

Enhanced Data Analytics and Predictive Modeling

Fintech is revolutionizing how asset managers analyze data. The sheer volume of data available today – from market trends and economic indicators to social media sentiment and individual investor behavior – is overwhelming for humans to process effectively. Fintech solutions, however, leverage powerful machine learning algorithms to sift through this vast dataset, identify patterns, and generate predictive models. This allows asset managers to make more informed investment decisions, potentially improving risk management and maximizing returns. The use of big data analytics is also enabling more personalized investment strategies, tailoring portfolios to individual client needs and risk tolerances with unprecedented precision.

Blockchain Technology and its Impact on Transparency and Security

Blockchain technology, the backbone of cryptocurrencies, offers significant potential for improving transparency and security within asset management. By providing an immutable record of transactions, blockchain can streamline the settlement process, reduce costs associated with reconciliation, and minimize the risk of fraud. Furthermore, the decentralized nature of blockchain can enhance security by reducing reliance on centralized intermediaries. While still in its early stages of adoption in the asset management industry, blockchain’s potential to revolutionize areas like fund administration, custody, and regulatory compliance is undeniable.

Improved Client Experience Through Digital Platforms

Fintech is transforming the client experience in asset management. Modern digital platforms offer investors greater access to their accounts, providing real-time portfolio updates, personalized financial planning tools, and seamless communication channels. These platforms often incorporate intuitive user interfaces and personalized dashboards, making it easier for investors to monitor their investments and engage with their advisors. This increased accessibility and user-friendliness are crucial in attracting and retaining clients in a competitive market.

The Democratization of Investing and Financial Inclusion

One of the most significant impacts of Fintech on asset management is the democratization of investing. Robo-advisors and other digital platforms have significantly lowered the barrier to entry for individual investors, allowing them to access professional investment management services that were previously only available to the wealthy. This increased access contributes to greater financial inclusion, empowering individuals to participate more effectively in the financial markets and build long-term wealth. This trend is likely to continue, further reshaping the landscape of the asset management industry.

The Challenges and Risks of Fintech Adoption

While Fintech offers numerous benefits, the adoption of these technologies also presents challenges and risks. Concerns about data security and privacy are paramount, as are the potential for algorithmic bias and the need for robust regulatory frameworks to ensure fair and transparent practices. The integration of new technologies can also be expensive and complex, requiring significant investment in infrastructure and employee training. Furthermore, the rapid pace of technological change necessitates constant adaptation and innovation to remain competitive.

The Future of Asset Management: A Symbiotic Relationship

The future of asset management is likely to be defined by a symbiotic relationship between human expertise and Fintech solutions. While algorithms can process vast amounts of data and execute trades with speed and efficiency, the human element remains crucial for strategic decision-making, client relationship management, and ethical considerations. The most successful asset managers will be those who effectively integrate Fintech tools into their operations, leveraging the power of technology while maintaining a human-centric approach to client service and investment strategy. Learn more about fintech disruption in asset management here: [link to buenosjuegosgratis.com]

Fintech’s Next Big Thing What’s Changing Money?

The Rise of Embedded Finance

Forget standalone financial apps. Embedded finance is seamlessly integrating financial services into non-financial platforms. Imagine booking a flight and paying with a buy-now-pay-later option directly through the airline’s website, or ordering groceries and getting instant loan offers based on your spending habits. This isn’t science fiction; it’s the rapidly expanding world of embedded finance, where the lines between financial and non-financial businesses are blurring. This allows for increased convenience for the consumer and new revenue streams for businesses of all sizes.

The Power of Open Banking and APIs

Open banking, with its standardized APIs, is the engine driving this revolution. It allows third-party providers to access customer financial data with their consent, paving the way for personalized financial products and services. This data-driven approach unlocks opportunities for hyper-personalized recommendations, improved credit scoring models, and tailored financial advice, all while enhancing customer experience and security through regulated access.

Decentralized Finance (DeFi) and its Growing Influence

While still nascent, decentralized finance (DeFi) continues to disrupt traditional financial systems. By leveraging blockchain technology, DeFi offers transparent, permissionless financial services, bypassing traditional intermediaries. Although challenges regarding regulation and accessibility remain, DeFi’s potential to democratize finance and offer innovative solutions, like decentralized lending and borrowing platforms, is undeniable. The space is evolving rapidly, with increased security measures and improved user experience becoming priorities.

Artificial Intelligence (AI) and the Future of Personalized Finance

AI is transforming the financial landscape, powering everything from fraud detection to algorithmic trading. But its most impactful role might be in personalizing financial services. AI-powered robo-advisors are already offering customized investment strategies, while sophisticated algorithms are analyzing spending habits to offer tailored financial advice and even predict potential financial difficulties. Ethical considerations are paramount, however, to ensure fairness and prevent bias in AI-driven financial decision-making.

The Expanding Role of Blockchain Beyond Cryptocurrency

While cryptocurrency remains a significant part of the blockchain narrative, its application extends far beyond digital currencies. Blockchain’s inherent security and transparency make it ideal for tracking assets, streamlining supply chains, and securing digital identities. In finance, this translates to enhanced security for transactions, improved auditability, and potentially faster, cheaper cross-border payments. This technology is laying the foundation for a more secure and efficient financial system.

The Metaverse and the Future of Digital Payments

The metaverse, a persistent, shared 3D virtual world, presents unique challenges and opportunities for fintech. As more people interact and transact within these digital environments, new payment methods and financial systems will emerge. This could involve virtual currencies, decentralized marketplaces, and innovative forms of digital asset ownership, potentially reshaping how we think about money and financial transactions altogether.

Regulation and the Balancing Act

The rapid pace of fintech innovation necessitates a careful balancing act between fostering innovation and ensuring consumer protection. Regulators worldwide are grappling with how to adapt to this rapidly changing landscape, aiming to create a framework that encourages growth while mitigating risks associated with new technologies and business models. Finding the right balance will be crucial for the sustainable growth of the industry and maintaining consumer trust.

Sustainability and the Green Finance Movement

The growing awareness of climate change is driving a surge in green finance, with fintech playing a crucial role. From developing innovative financing mechanisms for renewable energy projects to creating platforms for sustainable investments, fintech is helping to channel capital towards environmentally friendly initiatives. This trend is likely to gain significant momentum in the coming years, shaping the future of finance and investment. Visit here to learn about fintech disruption.