ESG Investing A Better Future for Your Money

What is ESG Investing?

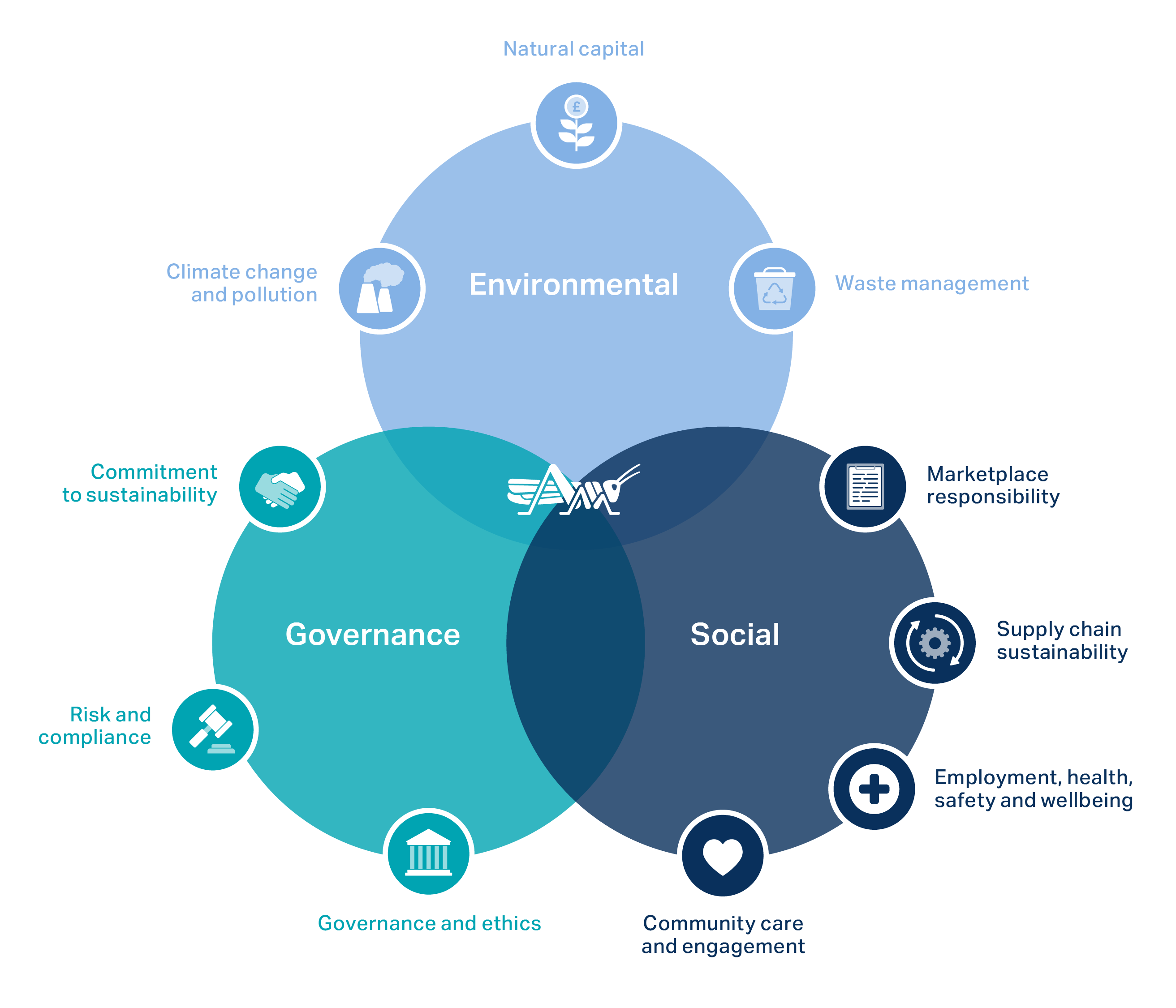

ESG investing, short for Environmental, Social, and Governance investing, is an approach to investing that considers a company’s impact on the environment, its social responsibility, and its corporate governance practices. It’s not about sacrificing returns for values; instead, it’s about integrating these factors into investment decisions to identify companies that are better positioned for long-term success. These companies tend to be more resilient to risks and better positioned to capitalize on emerging opportunities. It’s about looking beyond traditional financial metrics to assess a more holistic picture of a company’s viability and potential.

Environmental Factors: A Planet-Conscious Approach

The environmental aspect of ESG investing focuses on a company’s impact on the planet. This includes things like its carbon footprint, waste management practices, water usage, and commitment to renewable energy. Companies with strong environmental performance are often better equipped to navigate evolving environmental regulations and benefit from the growing demand for sustainable products and services. Investors are increasingly seeking out companies actively working to reduce their environmental impact, contributing to a greener future while potentially boosting their investment portfolio.

Social Responsibility: People Matter

The social component of ESG considers how a company treats its employees, customers, suppliers, and the wider community. This encompasses aspects like labor practices, diversity and inclusion, data privacy, product safety, and community engagement. Companies with strong social performance are often viewed favorably by consumers and attract and retain top talent. Investing in socially responsible companies can align your investments with your personal values while potentially reducing reputational risk associated with unethical business practices.

Governance: Strong Foundations for Success

Governance refers to a company’s leadership structure, executive compensation, auditing practices, and overall transparency. Strong corporate governance promotes accountability and reduces the risk of fraud and corruption. Companies with effective governance structures tend to be more stable and reliable long-term investments. This aspect of ESG investing is crucial as it lays the foundation for ethical and sustainable business operations.

How ESG Investing Benefits You

ESG investing offers numerous benefits beyond simply aligning your investments with your values. Studies suggest that ESG companies may outperform their non-ESG counterparts over the long term. This is because companies with strong ESG profiles often demonstrate better risk management, innovation, and long-term planning. By focusing on ESG factors, investors can potentially reduce their exposure to financial risks associated with environmental damage, social unrest, or poor corporate governance. Furthermore, it allows investors to contribute towards positive social and environmental change.

Finding ESG Investments: Practical Steps

Integrating ESG into your investment strategy can be easier than you think. Many brokerage firms and investment platforms offer ESG-focused funds, ETFs (Exchange-Traded Funds), and individual stock screenings. You can also research companies directly using publicly available ESG ratings and reports from various organizations. Remember to carefully consider your risk tolerance and investment goals when choosing ESG investments. It’s always wise to diversify your portfolio to manage risk effectively, even within the ESG space.

Beyond the Numbers: A Holistic Approach

ESG investing isn’t just about numbers; it’s about considering the broader impact of your investments. By considering environmental, social, and governance factors, you’re not just making a financial decision; you’re actively participating in creating a more sustainable and equitable future. It encourages companies to improve their practices, driving positive change across various industries and contributing to a more responsible global economy. This holistic perspective offers both financial and ethical returns, providing a compelling reason for integrating ESG into your investment strategy.

The Future of Finance: ESG’s Growing Influence

ESG investing is rapidly gaining momentum, driven by increasing investor demand, stricter regulations, and a growing awareness of the interconnectedness between business and society. As the world grapples with climate change, social inequality, and other global challenges, ESG is becoming increasingly crucial for long-term investment success. By incorporating ESG factors into your investment decisions, you’re positioning yourself for success in a world that increasingly values sustainability and social responsibility. Please click here to learn more about sustainable investing and ESG.

Sustainable Investing Making Money & a Difference

What is Sustainable Investing?

Sustainable investing, also known as responsible investing or ESG (environmental, social, and governance) investing, goes beyond simply seeking financial returns. It integrates environmental, social, and governance factors into investment decisions. This means considering a company’s impact on the planet, its treatment of its workers and community, and its corporate governance practices alongside traditional financial metrics. It’s about aligning your investments with your values and contributing to a more sustainable future.

The Financial Case for Sustainable Investing

Many believe sustainable investing sacrifices profitability for ethical considerations. However, a growing body of research suggests that integrating ESG factors can actually enhance long-term financial performance. Companies with strong ESG profiles often demonstrate better risk management, innovation, and long-term resilience. They tend to attract and retain top talent, build stronger customer relationships, and face fewer regulatory and reputational risks. This translates into potentially higher returns and reduced volatility over time.

Identifying Sustainable Investments

Finding suitable sustainable investments can be easier than you think. Many asset managers now offer dedicated sustainable investment funds, ranging from equity and fixed-income portfolios to alternative investments. Look for funds that clearly outline their ESG criteria and investment strategies. Independent ratings agencies also provide ESG scores for companies, helping you assess their sustainability performance. It’s wise to engage with your financial advisor to identify investments aligned with your personal risk tolerance and ethical priorities.

Different Approaches to Sustainable Investing

There’s a spectrum of approaches within sustainable investing. Some investors focus on negative screening, avoiding companies involved in specific harmful activities like fossil fuels or tobacco. Others adopt positive screening, actively seeking out companies with strong ESG profiles. Impact investing aims to generate measurable social and environmental impact alongside financial returns. Finally, shareholder engagement involves actively engaging with companies to encourage them to adopt more sustainable practices.

Minimizing Greenwashing

It’s crucial to be wary of “greenwashing,” where companies exaggerate their sustainability credentials to attract investors. Do your due diligence. Scrutinize a company’s sustainability reports, looking for specific, measurable, achievable, relevant, and time-bound (SMART) goals. Independent verification of ESG data is a strong indicator of authenticity. Look for companies that transparently disclose their environmental and social footprint, as well as their governance structure.

Beyond Financial Returns: The Social Impact

The benefits of sustainable investing extend beyond personal finance. By investing in companies committed to sustainability, you’re directly contributing to positive change. Your investment dollars can support the transition to a cleaner energy future, promote social equity, and improve corporate governance practices. This has a ripple effect, fostering innovation, creating jobs in emerging green sectors, and improving the overall well-being of communities and the planet.

Getting Started with Sustainable Investing

Starting your sustainable investing journey is simpler than you might imagine. You can begin by gradually shifting a portion of your portfolio towards sustainable investments. Many brokerage accounts offer tools and resources to screen for ESG-focused companies and funds. Talk to your financial advisor to incorporate sustainable investing into your overall financial plan, ensuring it aligns with your risk tolerance and financial goals. Remember, even small changes can make a big difference.

The Future of Sustainable Investing

The sustainable investing landscape is constantly evolving. Increasing regulatory pressure, growing consumer demand for ethical products and services, and a rising awareness of climate change are driving more capital towards sustainable investments. As the field matures, we can expect greater standardization of ESG data, more sophisticated investment strategies, and even more compelling evidence of the link between sustainability and financial performance. The future looks bright for those seeking both financial returns and positive social and environmental impact. Read also about ESG sustainable investing.