The Rise of Fintech Lending and its Disruptive Power

The lending landscape has undergone a seismic shift in recent years, largely driven by the innovative force of Fintech companies. These agile businesses, unburdened by the legacy systems and bureaucratic inertia of traditional banks, have rapidly redefined how individuals and businesses access credit. They’ve leveraged technology to streamline processes, reduce costs, and broaden access to a wider pool of borrowers, ultimately making credit more available and, in many cases, more affordable.

Fintech’s Technological Edge: Speed, Efficiency, and Accessibility

Fintech lenders utilize sophisticated algorithms and data analytics to assess creditworthiness far quicker than traditional institutions. This speed translates into faster loan approvals and disbursements, a crucial factor for borrowers facing urgent financial needs. Furthermore, their online platforms offer a seamless, 24/7 accessible borrowing experience, eliminating the need for physical visits to branches and lengthy paperwork. This accessibility is particularly beneficial for underserved communities and those in geographically remote areas.

The Data-Driven Approach: A Double-Edged Sword

Fintech’s reliance on data analysis is both a strength and a potential weakness. While it enables them to make faster and potentially more accurate credit assessments, it also raises concerns about data privacy and potential biases embedded within algorithms. The use of alternative data sources, such as social media activity and online spending habits, opens doors to broader credit access but also necessitates careful consideration of ethical implications and regulatory compliance.

The Latest Fintech Lending Shakeup: Increased Competition and Consolidation

The Fintech lending sector is currently experiencing a period of rapid growth and intense competition. This has led to a flurry of mergers and acquisitions, as larger players seek to consolidate their market share and expand their product offerings. Smaller players are facing pressure to innovate and differentiate themselves in order to survive in this increasingly crowded marketplace. This consolidation, while creating stronger entities, might also potentially limit the diversity of offerings and increase the overall market power of a few major players.

Navigating Regulatory Hurdles and Maintaining Trust

The rapid expansion of Fintech lending has also brought increased regulatory scrutiny. Governments worldwide are grappling with how to effectively regulate this dynamic sector while fostering innovation and protecting consumers. Building and maintaining trust is crucial for Fintech lenders, as concerns about data security, predatory lending practices, and transparency remain prevalent. Addressing these concerns through robust internal controls and transparent practices is vital for long-term success.

The Future of Fintech Lending: AI, Open Banking, and Beyond

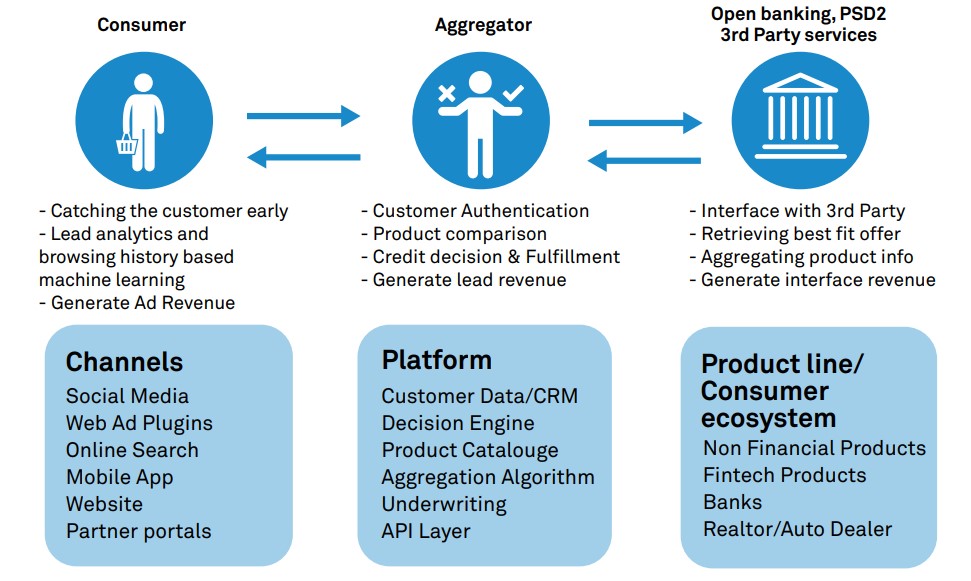

The future of Fintech lending is likely to be shaped by advancements in artificial intelligence (AI), open banking, and blockchain technology. AI is expected to further refine credit scoring models, personalize loan offerings, and automate processes even more efficiently. Open banking will facilitate seamless data sharing between lenders and borrowers, potentially leading to more competitive rates and improved customer experiences. Blockchain technology may enhance transparency and security in loan transactions, reducing fraud and simplifying documentation.

The Impact on Traditional Banking

The rise of Fintech lending is forcing traditional banks to adapt and innovate. Many established institutions are now investing heavily in their own digital lending platforms and exploring partnerships with Fintech companies to enhance their capabilities. The pressure to compete is pushing banks to improve their customer service, streamline their processes, and offer more competitive rates and products. This competition ultimately benefits consumers with a wider variety of choices and improved overall services.

Challenges and Opportunities Remain

Despite the transformative impact of Fintech lending, significant challenges remain. Ensuring responsible lending practices, addressing biases in algorithmic decision-making, and protecting consumer data are paramount. However, the opportunities are equally immense. Fintech lending has the potential to unlock access to credit for millions of underserved individuals and businesses, driving economic growth and financial inclusion on a global scale. The sector’s evolution will continue to be a dynamic and exciting journey, constantly adapting to technological advancements and evolving regulatory landscapes. Please click here to learn about fintech disruption in lending.